Setting the Stage – Let’s Talk Real Life

Imagine this: You run a bustling retail business. Your aisles are filled with products that customers desire, your countertops thrum with the noise of transactions, and your coffers are a testament to your business acumen. To manage your growing enterprise, you rely on a store management software you believed would help make things efficient and convenient.

Fast forward a few months, your once reliable software starts showing signs of trouble. Discrepancies begin to appear in your financial records, security lapses seem more prevalent, and gleaning insightful data from your system becomes a Herculean task. You can’t help but ask, “Where could I have gone wrong?”

Here’s the thing: amidst all the technological provisions you’ve set up, there’s a good chance your store management software is missing out on incorporating a significant element — the time-tested principle of double-entry accounting. The lack of this fundamental aspect can have rippling effects on your system’s integrity, security, and observability, leading to the challenges you’re grappling with.

This is the rationale for highlighting the critical role of double-entry accounting in FinTech products, such as your store management software. Integrating this core accounting methodology not only helps in maintaining accurate financial records, but it also fortifies the system’s security and enriches your ability to observe and make sense of your financial data. And these could, after all, be the critical levers for your business success in our digital age.

Understanding Double-Entry Accounting

In its most fundamental sense, double-entry accounting is a systematic method that records two aspects of every financial transaction. The system revolves around the principle that debits must equal credits, thereby maintaining a balance in the ledgers. This concept can be further understood by familiarizing with the key concepts, i.e., Account and Transaction.

An account in the context of double-entry accounting is not entirely different from traditional bank accounts. It refers to individual records for each type of asset, liability, equity, revenue, and expense. For instance, an organization could have different accounts for cash, accounts receivable, accounts payables, etc.

When we talk about transactions, they constitute any event that impacts the financial position of your organization and can be reliably measured. This could range from purchasing goods from a supplier, selling services to clients, paying off debts, and so forth. Each transaction will lead to at least two changes to the company’s accounts – one debit entry and one credit entry.

The movement of funds from one account to another includes a debit from one account and an equal credit to another. For instance, if a company purchases an asset, it debits, i.e., increases, the appropriate asset account, and simultaneously credits, i.e., reduces, the cash or accounts payable, depending upon if it was a cash purchase or on credit.

Reconciliation is another critical aspect in the realm of double-entry accounting. It refers to the process of comparing two sets of records to ensure they are in agreement. This is vital in ensuring balances match across all accounts, identifying fraudulent activities, detecting errors or discrepancies, and ensuring compliance with financial regulations.

A well-constructed double-entry accounting module can essentially overcome the issues associated with system integrity, security and observability. Since every transaction is reflected in two accounts, it provides a much clear and comprehensive view of the business’s financial standing. Moreover, the chances of errors or frauds are significantly reduced given the counterbalancing effect of the double-entry system. Any irregularities can be easily identified and rectified through regular reconciliation.

Designing a Double-Entry Accounting System

Implementing a double-entry accounting system into any fintech product is a task that requires detailed planning, deliberate design, and careful execution. This accounting model, while seemingly straightforward on a ledger, entails a host of deltas when being integrated into a fintech system. Below we’ve broken down the process into comprehensive chunks for better understanding.

Database Design

A crucial starting point for a double-entry accounting system is the database design as it’s going to be the primary place to store all your financial transactions. The design generally necessitates two central tables: Account and Transaction.

Account table stores user account information including fields like account_id, user_id, account_type, account_balance etc. Each user may have multiple accounts depending on your business needs.

Transaction table captures the data about transactions occurring between these accounts where we store fields like transaction_id, debit_account_id, credit_account_id, amount, transaction_date, transaction_type etc. Here, debit_account and credit_account represent the two accounts impacted by the transaction as per double-entry accounting principles.

Further, database design of the accounting module usually includes more advanced elements, such as multi-currency, notifications and audit requirements.

Transaction Handling

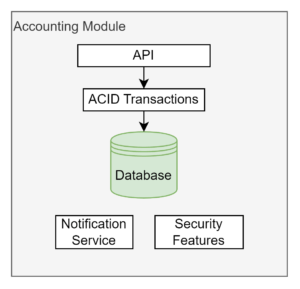

To ensure data integrity and consistency, database transactions are implemented. This means that if any transaction fails at any one point, the entire transaction is rolled back – ensuring that money is neither mysteriously lost nor created within your system. Additionally, the transaction needs to guarantee correctness across multiple tasks. This is quite often accomplished by using ACID (Atomicity, Consistency, Isolation and Durability) properties which most relational databases naturally support.

API Design

An API forms the bridge between your application and the double-entry accounting system. A well-designed API should enable operations such as creating accounts, initiating transfers, and querying for balance or transactions history. The API should validate all the inputs rigorously to avoid any fraudulent transactions. Depending on the overall system security architechture API may require authentication, authorization and network-level security configuration.

Security

Securing your accounting system is vital, particularly because financial data is involved. Applying encryption to the data at rest and in transit, audit logs, adhering to PCI compliance, implementing strong access control and identity verification features are just some of the measures to keep your fintech system secure.

Why Opt for an Expert Consultancy Firm

Choosing a competent consulting firm plays a pivotal role in designing robust fintech systems. This decision can greatly influence aspects including security, reliability, observability, and ultimately, return on investment.

At Exilion, we treat Security as a main pillar of any financial system. From cloud engineering and access control to application logic and securing data in transit, we apply industry best practices to create the most secure applications for our Clients.

Observability is another crucial feature. We build systems with integrated monitoring and alerting capabilities for real-time assessment and swift troubleshooting.

While the initial investment into a properly designed system might appear significant, the long-term benefits such as improved operational efficiency, customer satisfaction, reduced risks, and increased profits underscore a rewarding Return on Investment.

Partnering with us will ensure successful implementation of your fintech initiatives, courtesy of our commitment to excellence and tailored strategies. Contact our team to kickstart your fintech project planning, leveraging our comprehensive industry expertise and dedication to your success.